I recently spent some time looking at CIPA data and wrote a few articles on my blog pertaining to these camera industry statistics. I thought Photography Life readers may find some of the data of interest. What follows are a few thoughts about the camera market, based on my interpretation of CIPA data. It should be noted that data is simply data and two people can look at the same information and arrive at differing interpretations. For folks who find the data of interest you can pop over to my blog to read a bit more. If you want to see the actual data reports I would encourage you to visit the CIPA website and access the data directly…then put on a pot of coffee, grab a calculator or open up Excel on your computer…and have some fun!

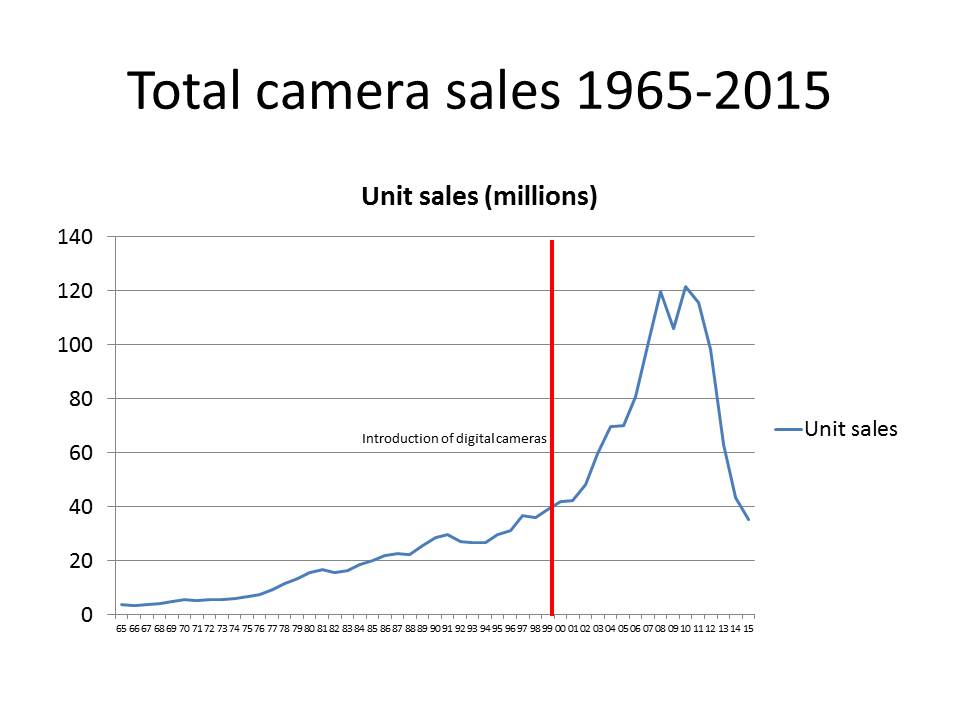

If we look at camera sales from a historical perspective we can see steady growth from the mid 1970’s through to 2001. When digital cameras were first introduced in the market it took about three years for them to really gain traction, then unit sales rose dramatically.

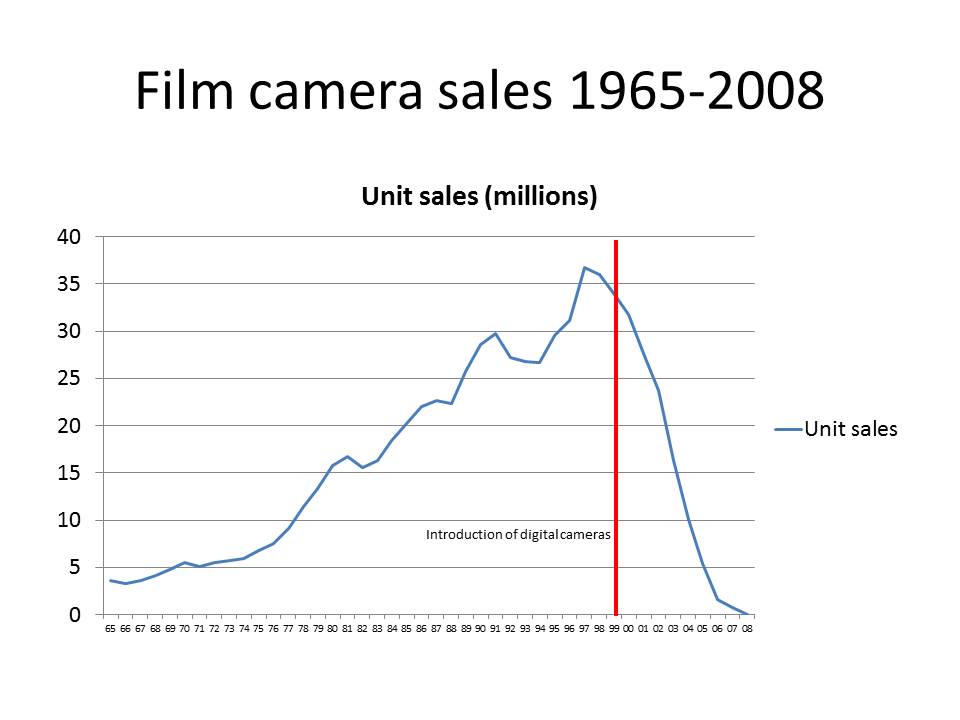

The chart above shows how quickly digital photography was adopted by the camera market. By 2008 the film camera market was basically dead.

Whenever a new technology like digital photography enters a market there are winners and losers. The first casualty was film cameras being supplanted by digital cameras.

The first cellphone with a camera was introduced in the South Korean market by Samsung in June 2000. That was followed by the first phone with a camera being sold in the United States in November 2002. Consumers loved the convenience and by the end of 2003 over 80 million of these new phones were sold worldwide. By 2011 the sales of cellphones reached into the hundreds of millions.

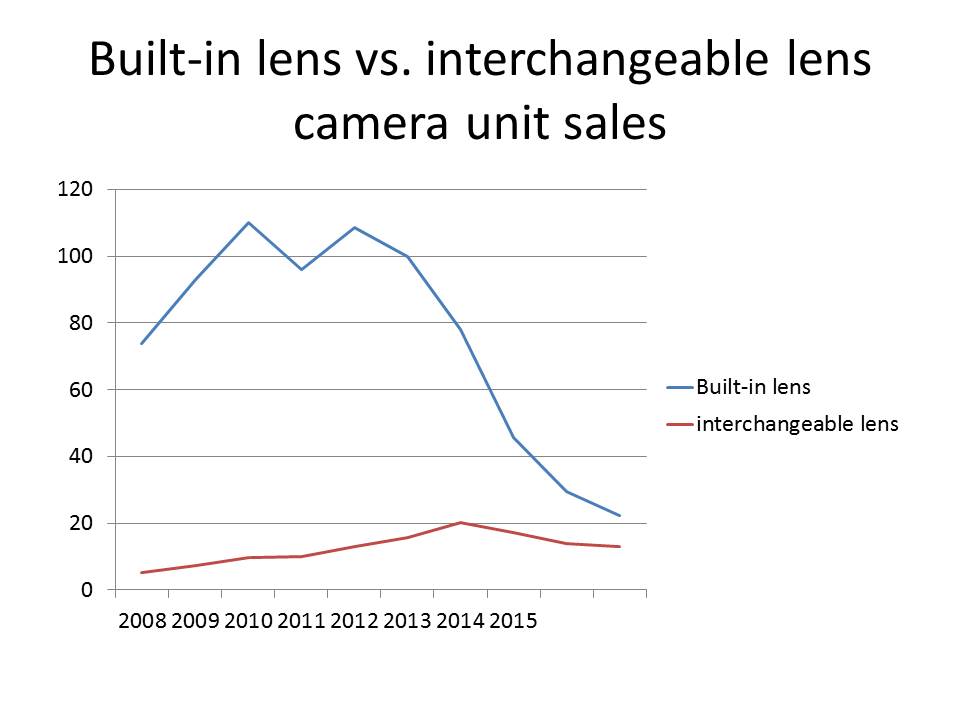

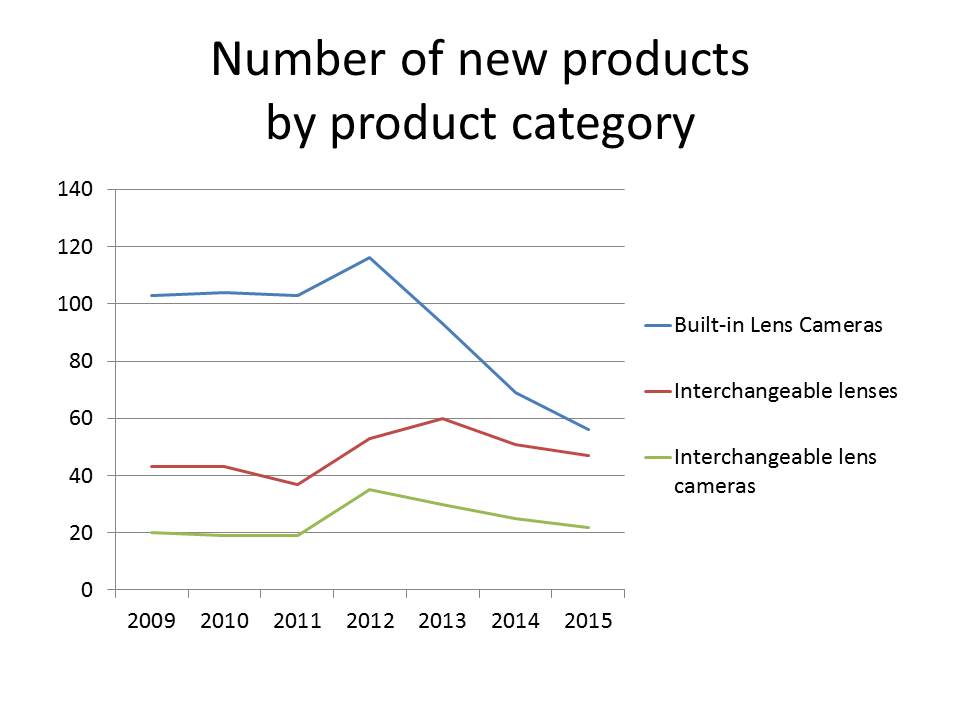

As you can see in the graph above the built-in lens camera market has dramatically fallen with the impact of the camera phone. But, there are also winners.

The sale of interchangeable lenses has increased dramatically as people needed to convert their gear to digital or chose to upgrade it to newer technology. While the unit sales of interchangeable lenses has softened since they hit their peak in 2012, as of the end of 2015 they are still more than triple the high water mark reached in 1997 in the film camera days.

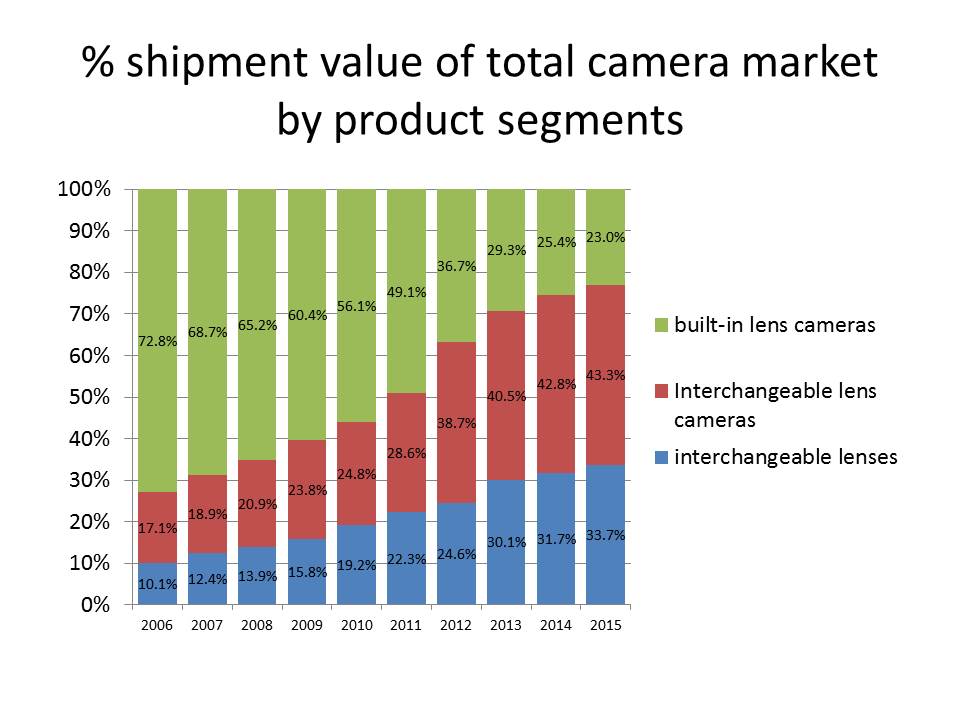

The above graphic shows the impact of the shift in units of various product segments in the camera market have impacted overall segment value. The built-in lens camera segment which used to generate 72.8% of overall shipment value in 2006 has collapsed to 23% in 2015 and now is the smallest segment. CIPA is forecasting further declines in the built-in lens camera market.

The above graphic shows the impact of the shift in units of various product segments in the camera market have impacted overall segment value. The built-in lens camera segment which used to generate 72.8% of overall shipment value in 2006 has collapsed to 23% in 2015 and now is the smallest segment. CIPA is forecasting further declines in the built-in lens camera market.

During the past few years we have seen camera manufacturers introduce higher content and more premium built-in lens cameras. Strategically this helps distance built-in lens cameras from camera phone capability, as well as generate more per unit revenue as overall unit sales continue to decline. The importance of the interchangeable lens camera segment and interchangeable lens segment have both increased in shipment value.

As the sales of built-in lens cameras declined the camera manufacturers shifted their research and development efforts away from this segment and put more focus on interchangeable lenses and interchangeable lens cameras.

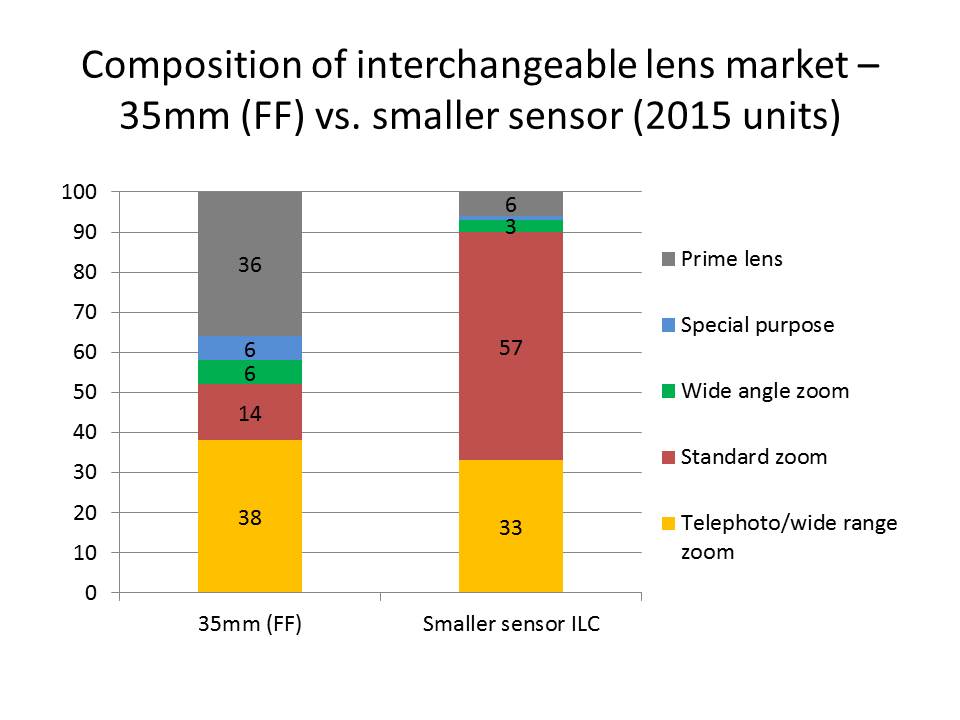

If we examine 2015 CIPA data regarding the composition of the interchangeable lens market we see a significant difference between the 35mm (full frame) market and the ‘less than 35mm’ market. Only 6% of the lens units sales in the smaller sensor market are prime lenses. This compares with 36% in the 35mm (full frame) market. Sales of zoom lenses constitute 93% of interchangeable lens sales in the smaller sensor market compared to 58% in the 35mm (full frame) market. Much of this could be the potential impact of more camera/lens kits being sold to the buyers of smaller sensor cameras. Another factor could be APS-C owners buying full frame lenses and using them on their cropped sensor gear.

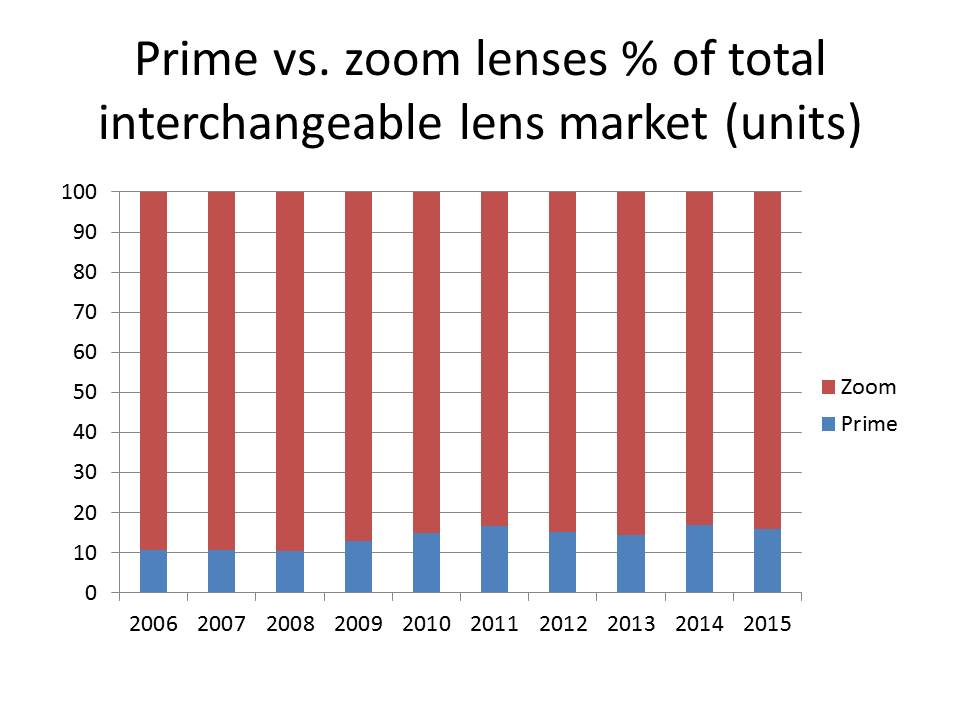

When we examine the global interchangeable lens market regardless of camera sensor size we can still see the dominance of zoom lenses which outsell primes by a ratio of 5.6:1. Approximately 85% of all interchangeable lenses sold globally are zooms. As various segments like the M4/3 and CX markets mature it will be interesting to see if there is any increased penetration of prime lenses. Next, let’s have a look at the impact of non-SLR (mirror-less) cameras.

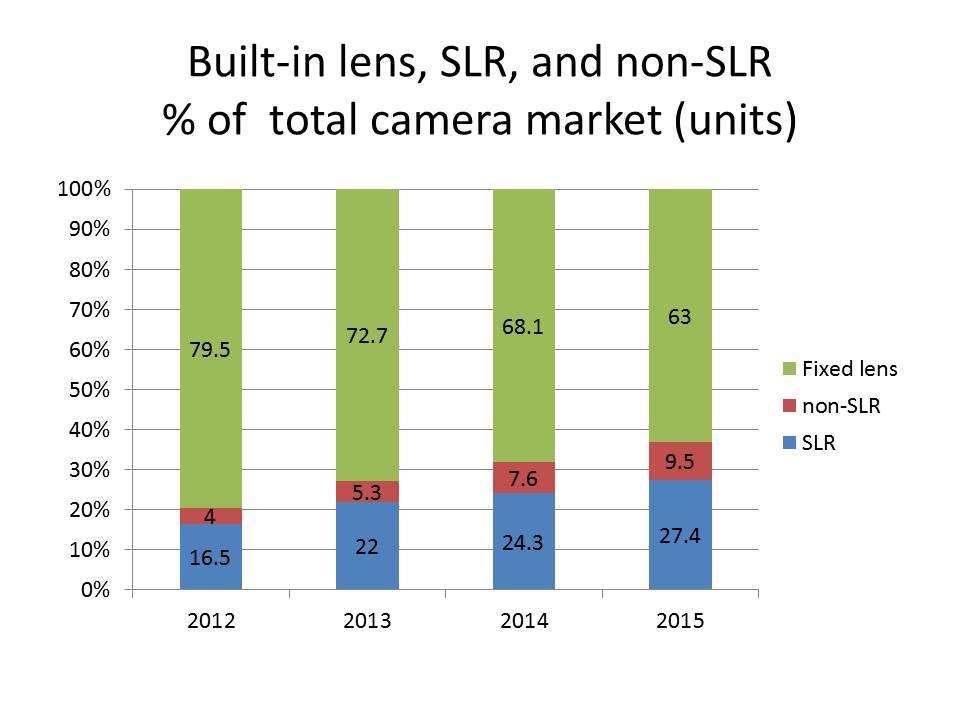

In terms of unit sales we can see that from 2012 through to 2015 the market share of non-SLR (mirror-less) cameras has more than doubled from 4% to 9.5%. Built-in lens cameras still generate the lion’s share of the market’s unit sales but now constitute less than 2/3 of overall volume.

In terms of shipment value the interchangeable lens camera market has been growing in importance with SLR’s holding just under 50% of overall shipment value and non-SLR’s (mirror-less) almost doubling in value from 8.5% in 2012 to 16.9% in 2015.

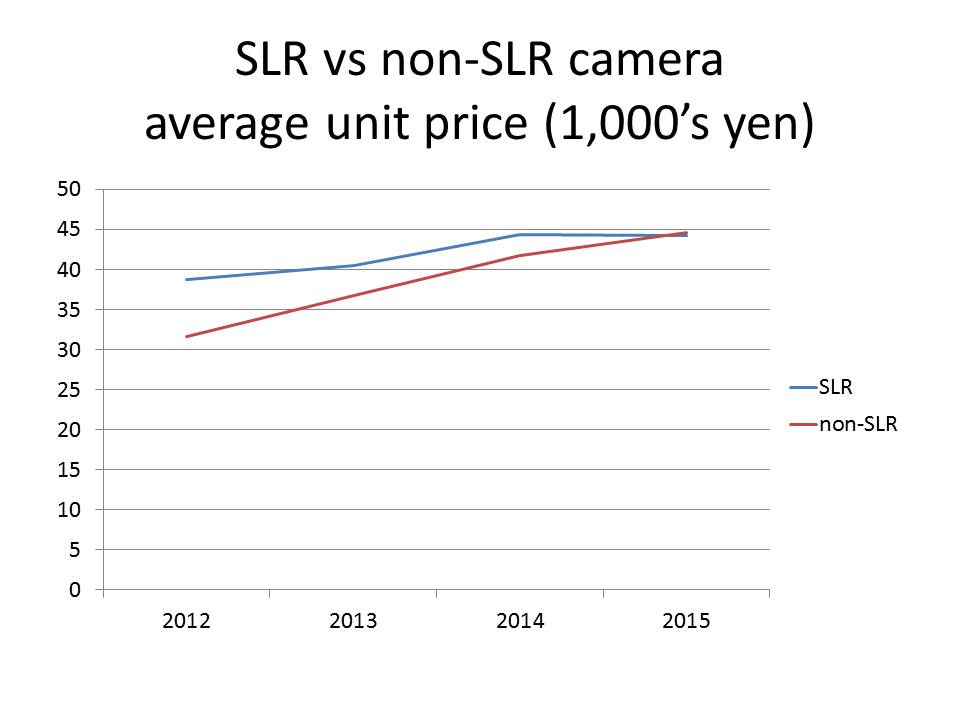

The per unit shipment value of a non-SLR (mirror-less) camera has risen over time and now is slightly higher than an SLR camera. We are likely seeing the impact of Sony 35mm (full frame) bodies and higher end M4/3 bodies from brands like Olympus, Panasonic and Fujifilm.

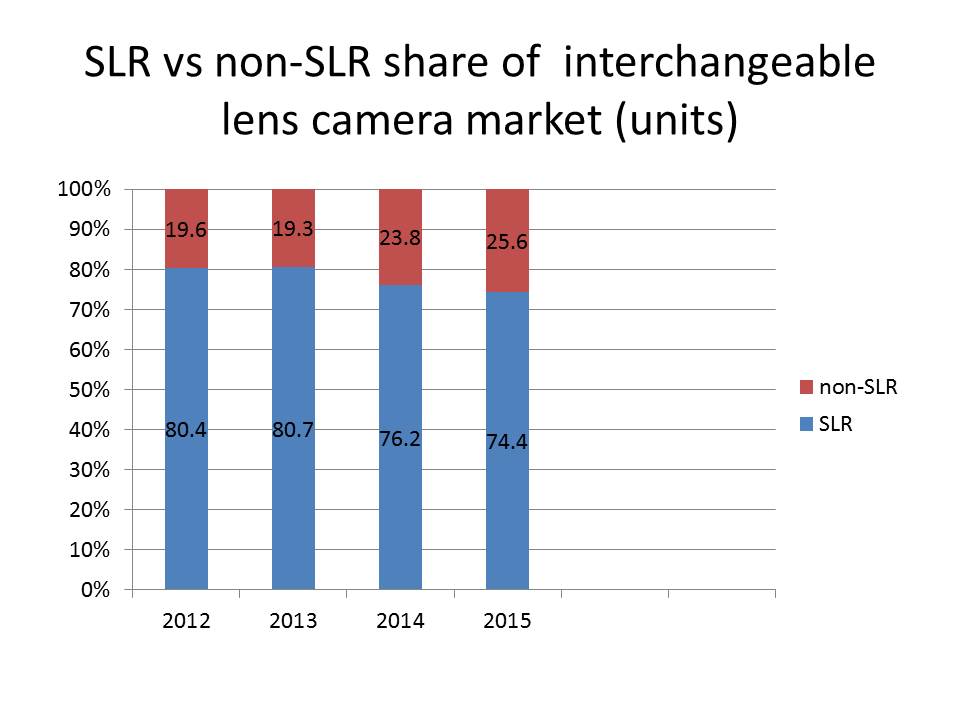

When we examine just the interchangeable lens camera market we can see that non-SLR’s (mirror-less) now account for over 1/4 of unit sales globally. It should be noted that the adoption rate of non-SLR (mirror-less) varies considerably around the globe with the Americas having the lowest rate.

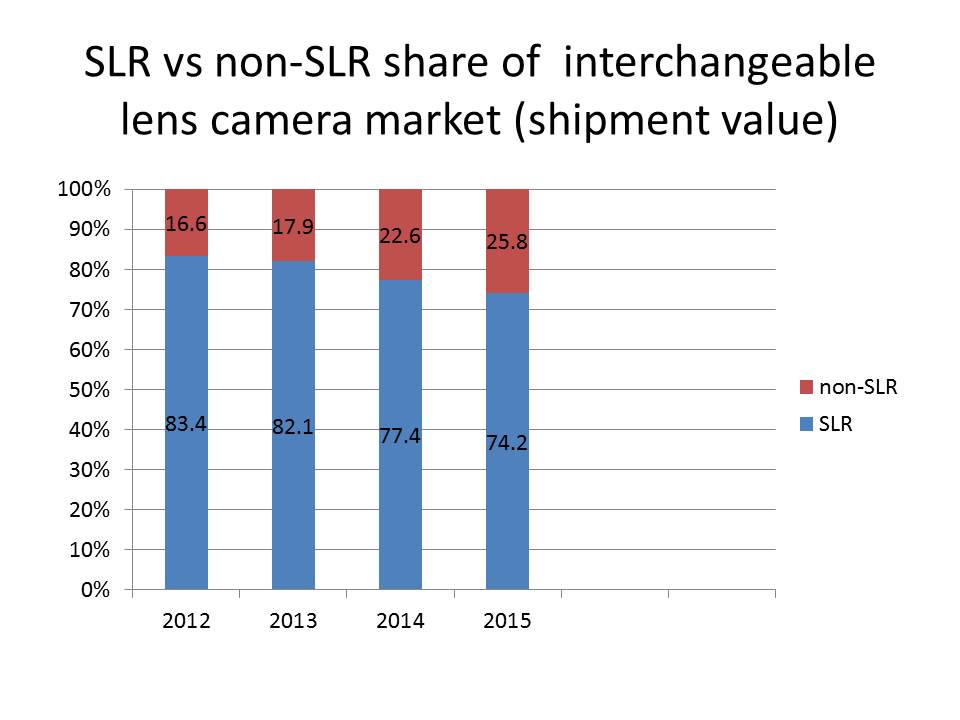

The share of shipment value of non-SLR’s (mirror-less) has also grown and now stands at 25.8% of the interchangeable lens camera market value. If this trend continues at its current pace it would take about 5 years for the shipment value of non-SLR’s to overtake SLR’s in market value and will likely represent about 1/3 of market value by the end of 2017. If Canon and Nikon do not enter the non-SLR (mirror-less) interchangeable camera market with a good complement of APS-C and/or full frame cameras by the end 2017 they will likely miss an important strategic window of opportunity.

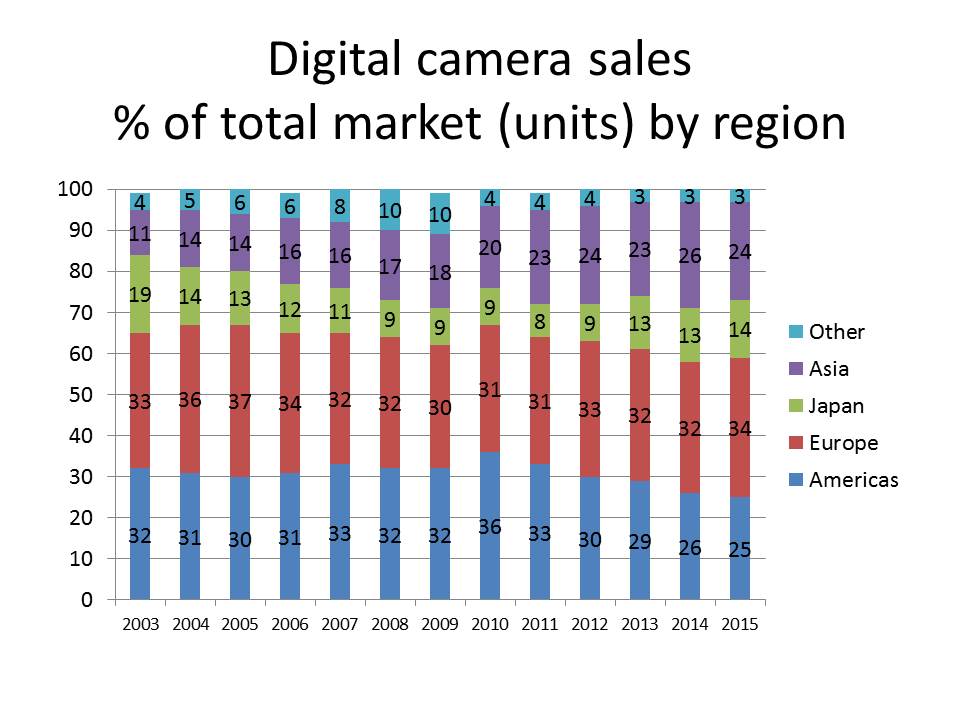

We can also see that the sales of digital cameras to various regions around the world has shifted over time with Europe being the largest digital camera market at about 34% of worldwide volume. This is followed by the Americas at 25% and closely followed by Asia at 24%. Japan is currently about 14% of worldwide digital camera sales.

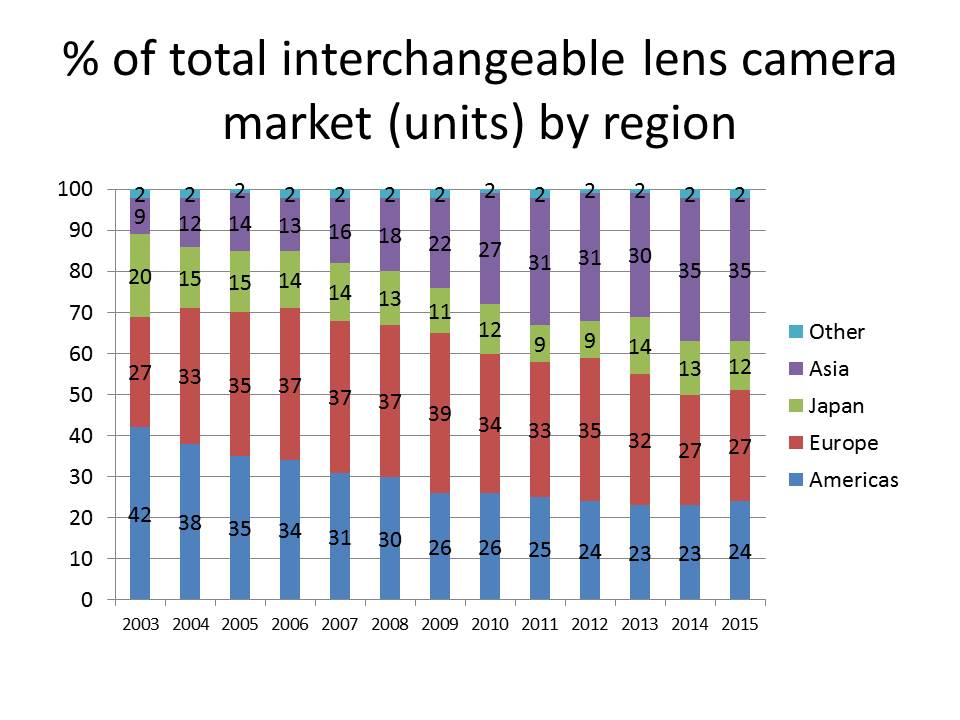

When we look at the sales of interchangeable lens cameras the data tells us a different story with the Asian market being the largest at 35% of global unit volume. This is followed by Europe at 27% and then the Americas at 24%. Japan represents about 12% of the global interchangeable lens camera market.

As consumers we sometimes scratch our heads when new products are introduced and we wonder what a particular manufacturer was thinking. It is always good to remember that many products like cameras are developed with a global market perspective and sometimes the needs of consumers in one part of the globe may overshadow the needs of smaller markets.

These are just a few quick highlights of the most recent data published by CIPA. If you’d like to see more please drop by my blog or visit the CIPA website directly. I also have my interpretation of the Nikon DL/Nikon 1 impact debate posted online.

Article and all graphics are Copyright Thomas Stirr. All rights reserved. No use, adaptation or duplication of any kind is allowed without written consent. This article was written specifically for use by Photography Life. If you see this article reproduced anywhere else it is an unauthorized and illegal use.

The post A Few Thoughts About the Camera Market appeared first on Photography Life.

from Photography Life https://photographylife.com/a-few-thoughts-about-the-camera-market

No comments:

Post a Comment